Welcome Bank 3.0 Mobile Payment Promote consumption revolution

Prefaced

[February 05, 2015] IDC has been estimated the technology industry trends of the past year (2014), and discovery it will base on the third platform formed of Mobile Computing, Cloud Services, Big Data and Social Networks four pillars to develop. The development of the Mobile Computing is particularly benefit from the far-reaching communication functions, the functional applications are development more rapid and even more popularization than the early mainframe computers, it is quickly becoming the role of the mobile payment market. So the global markets are all spend more on the development of the Mobile Payment market.

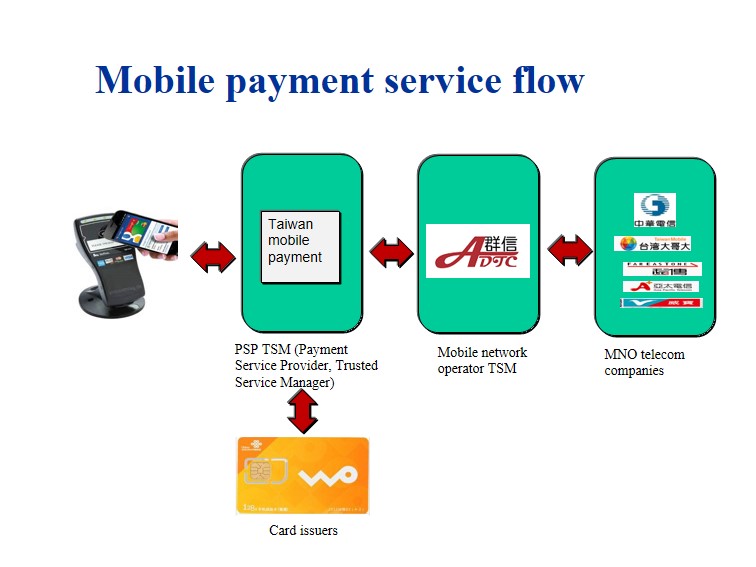

Since 2013, the FSC (Financial Supervisory Commission) had announced will opening the financial institution‘s applying for a mobile phone credit card service, let credit card combine with mobile phone, creating a trend of Mobile Payment. In order to supply a security mobile payment platform, Taiwan mobile payment company constructs PSP TSM (Payment Service Provider, Trusted Service Management) platform.

Alliance Digital Tech Co., a joint venture created by five telecommunications operators and EasyCard Corporation, also constructs MNO TSM (Mobile Network Operator Trusted Service Management) platform. After all the parts interface in the future, customers can transfer personal data to TSM for identification through an issuing bank, and then download the data in cards to a SIM card through OTA (Over the air) technology. After integrating the data into credit cards and debit cards into a SIM card, when pay by phone, customers is not limited to a single telecommunications company, and also is not limited to credit card types. Just after downloading the corresponding electronic money bag App, Customers can choose a variety of payment methods (such as credit cards, debit cards, saving card, EasyCard, saving payment accounts, etc.). The multifunctional payment application has formed across telecommunications companies, phone models, cards, saving accounts. Taiwan PSP 2014 draft law has been passed, according to which, O2O (Online to Offline) offline substantial transactions, saving and payment in multi-currency, and remittance without real transactions (limit 30,000 yuan) will be opened.

SYSCOM mobile payment service solution Brief

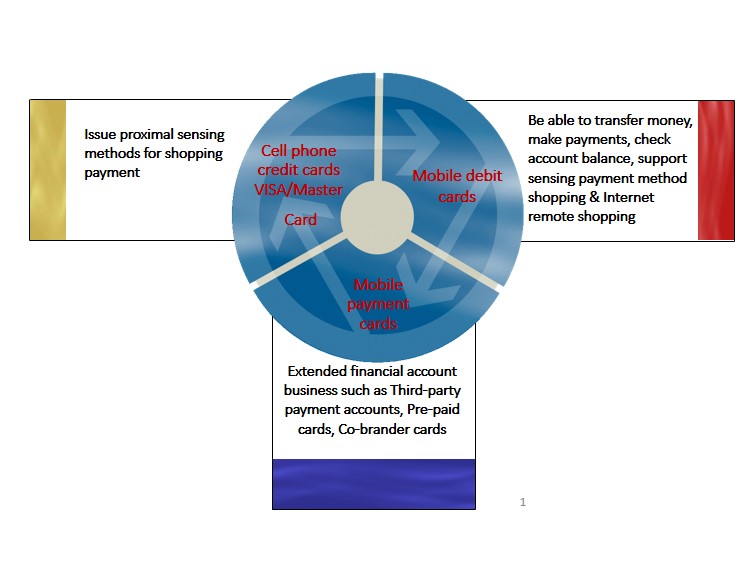

The mobile payment services include:mobile phone credit card, mobile financial card, mobile payment card, etc.

At present, the mobile payment solution can be achieved through the following techniques:

1. NFC

2. WAP

3. RFID

USSD

Ultrasound

QR Code

According the services of mobile phone credit cards and mobile banking card in domestic finance industry, to integrate the functions of credit cards and debit cards into NFC phones, customers only need to renew a U-SIM card and download the application provided by Taiwan Mobile Payment Company to register, and then apply to the bank, finally, download the card successfully through the air transmission technology (OTA: Over the Air).

Motive by a desire to serve customers, the SYSCOM is committed to software development and system integration, providing integrity solution of electronic and mobile payment services for customers in domestic financial industry as a road to Bank 3.0 era. TSM connection way is as follows:

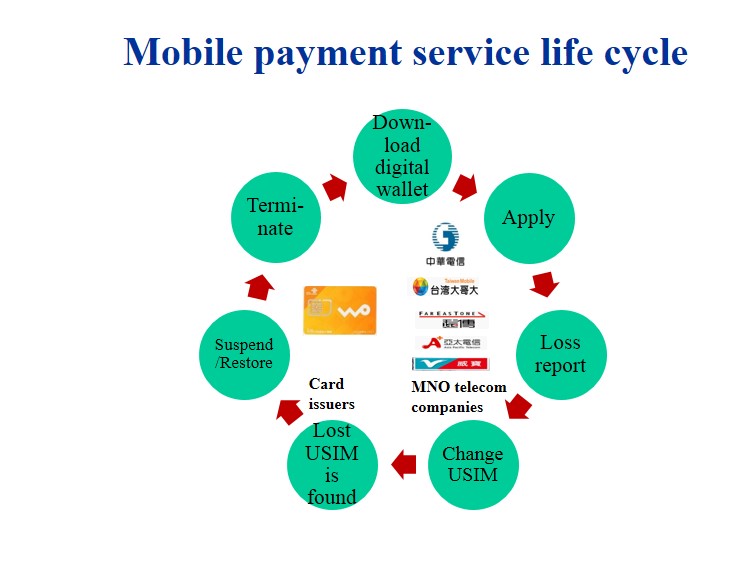

SYSCOM mobile payment solution also provides the card lifecycle management function of information exchange between Issue and MON, includes:

1.Application for mobile payment service operation

2.Application for report the loss of card function

3.Application USIM exchange function

4.USIM recovery function

5.Pause/Recovery function

6.Terminal mobile payment service operation

7.In addition, the solution also provides the background accounting server functions: cards in batch operation, file transfer operation, barcode printing, inter-bank transfer service, payment (tax) service, balance inquiry, Consumer debit large micro-payment non-contacting transaction, key creation, TAC verification etc.

Conclusion

More money types are emerging, from entity currency in the past to plastic currency now that is in readiness for the coming Bank 3.0 times. In future, there will be more modes of payments, such as mobile phone APP, chip cards, NFC, RFID, two-dimensional bar codes, etc. Every mobile payment tool has its strengths and weaknesses, however, users can choose one or more mobile payments tool basing on some specific needs. Therefore, there will be more divergences in the future mobile payments market than in the current card business. Nevertheless, mobile payment carrier is popular by customers in small payments market because of its low cost, and gradually erodes cash payment. Mobile payment will fully prevail in developed countries, for example, Britain, by the end of 2020, and then the global retail trade mobile payments will be dominated by mobile payment. Facing this new revolution in consumer behavior, it’s a smart decision for people in the finance industry to devote energy to mobile payment market to obtain an advantage over others. (The author is now serving in Financial Holdings Software Development Department of the SYSCOM.)

with the permission of the SYSCOM Group New Technology e-Magazine